or small business owners, startups, and self-employed professionals, insurance is a crucial aspect of protecting your business and personal assets. Having the right insurance policy in place can safeguard you against various liabilities, from third-party lawsuits to property damage caused by unexpected events like fires or floods. If you’re operating a small business or working independently in Canada and are seeking cost-effective insurance solutions, you should consider Zensurance, an online commercial insurance brokerage that caters to a wide range of industries. In this Zensurance review, we’ll cover everything you need to know about the company, how to apply for business insurance, and the advantages of choosing Zensurance as your insurance broker.

Zensurance is an online commercial insurance brokerage specializing in serving Canadian small businesses, entrepreneurs, self-employed professionals, and contractors. Commercial insurance is designed to protect businesses from financial losses resulting from unforeseen events during their daily operations, such as third-party injuries or property damage. With over 50 partnerships with leading Canadian insurance providers, Zensurance offers a seamless process for business owners and professionals to visit their website, complete an application, and receive a free insurance quote.

Zensurance provides a wide range of insurance coverage options to cater to the diverse needs of businesses and professionals. Some of the most common types of business insurance coverage available through Zensurance include:

Understanding which coverages you need, setting the right coverage limits, and choosing appropriate deductibles can be a complex task. Zensurance’s licensed brokers are here to provide expert guidance to help you determine the right level of coverage and ensure you’re neither underinsured nor over-insured. Your Zensurance broker will customize the policy to fit your specific needs.

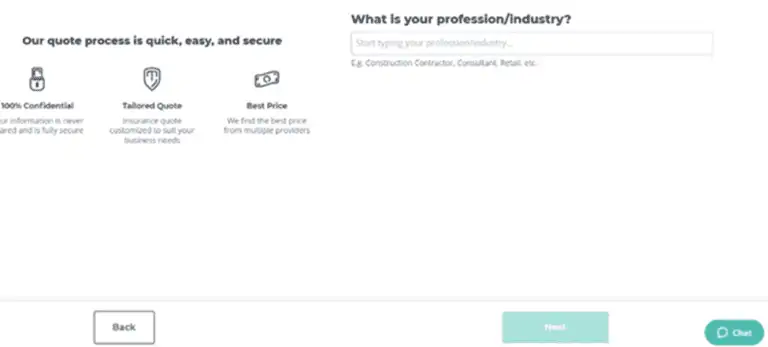

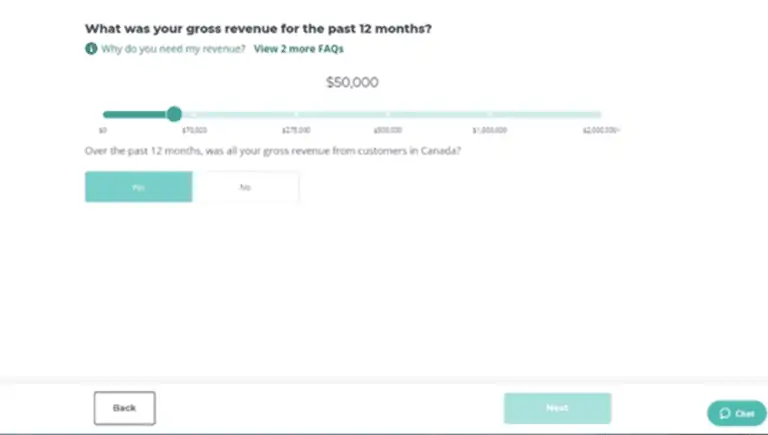

To apply for business insurance coverage through Zensurance, visit their website and click on the “get a quote” button, conveniently located on every page of the website. The online application process begins with a series of questions about your profession or business. The initial question pertains to your profession or industry. You’ll also be asked about your gross revenue over the past 12 months (for new businesses, you can enter $0).

The application will inquire about your expected earnings in the next 12 months, the products or services you offer, and additional details about your business, including:

After answering these questions, provide your email address, and Zensurance will email you the lowest quote available for the type of policy you need. The system will then display an overview of the selected coverages, suggest additional options, and ask for your confirmation.

Throughout the application process, a “live chat” button is available in the bottom right corner, connecting you to a licensed broker if you need assistance. Once you receive your quote, you can reach out to a Zensurance broker by phone, email, or live chat for further inquiries.

It’s important to note that Zensurance is an online insurance brokerage, not an insurance company. This means their licensed insurance brokers work for you and not a single insurance company. Zensurance’s brokers are trained and licensed by self-regulating industry bodies in each Canadian province, ensuring their expertise and trustworthiness. For instance, in Ontario, its brokers are licensed by the Registered Insurance Brokers of Ontario.

When you fill out an online application for a business insurance policy through Zensurance, their brokers handle the shopping for you. They leverage their network of over 50 insurance companies to find the coverage you need at competitive prices, often up to 35% less than their competitors. Moreover, Zensurance allows you to complete the online application at any time of day or night, providing you with a free, no-obligation insurance quote.

By working closely with you to understand your needs and potential risks, Zensurance brokers will tailor your policy to ensure you’re adequately protected, avoiding the pitfalls of being underinsured or overinsured. In the unfortunate event of a claim dispute, your Zensurance broker will advocate on your behalf, engaging with the insurance company to seek a favorable resolution.

Zensurance brokers recognize that insurance terminology can be complex. They are dedicated to explaining the intricacies of your policy and its limits in plain language. They also offer guidance on reducing your annual insurance costs by implementing risk mitigation measures.

Zensurance is a legitimate and licensed business insurance brokerage based in Toronto. Established in 2016, the company understands the unique challenges faced by small business owners. Zensurance has proudly served over 100,000 Canadian small businesses and entrepreneurs, receiving high praise from its customers with a remarkable 4.8 out of 5-star rating on Google Reviews.

Zensurance has revolutionized the business insurance landscape for small business owners, home-based businesses, and self-employed professionals by simplifying and demystifying the insurance purchasing process. If you are a small business owner, entrepreneur, or self-employed contractor in Canada, Zensurance is worth exploring for your business insurance needs.