PolicyMe steps in to address these questions and more. This digital life insurance company offers the convenience of purchasing life insurance online at an affordable rate by cutting out unnecessary distribution costs and underwriting steps.

In essence, PolicyMe has streamlined the life insurance acquisition process, allowing savings of 10% to 20% on average, all from the comfort of your home.

PolicyMe is an online life insurance company enabling Canadians to swiftly purchase term life insurance. Established in 2018, the company serves all provinces in Canada.

PolicyMe’s innovative life insurance platform simplifies the application process, reducing the wait time for determining eligibility and costs.

The company offers term life insurance policies for individuals aged 18-75, allowing coverage for varied term lengths, ranging from 10 to 30 years and amounts between $100,000 and $5 million.

The Process of Applying for PolicyMe Life Insurance

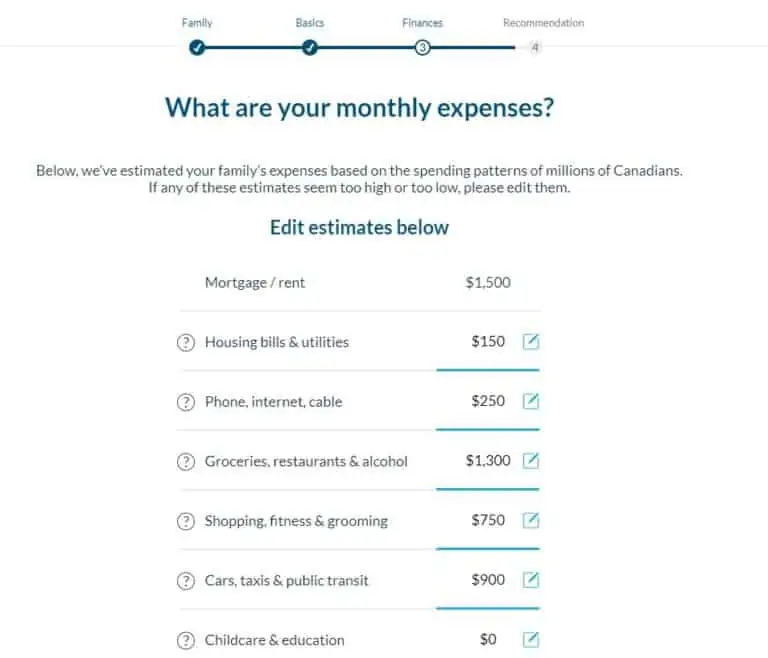

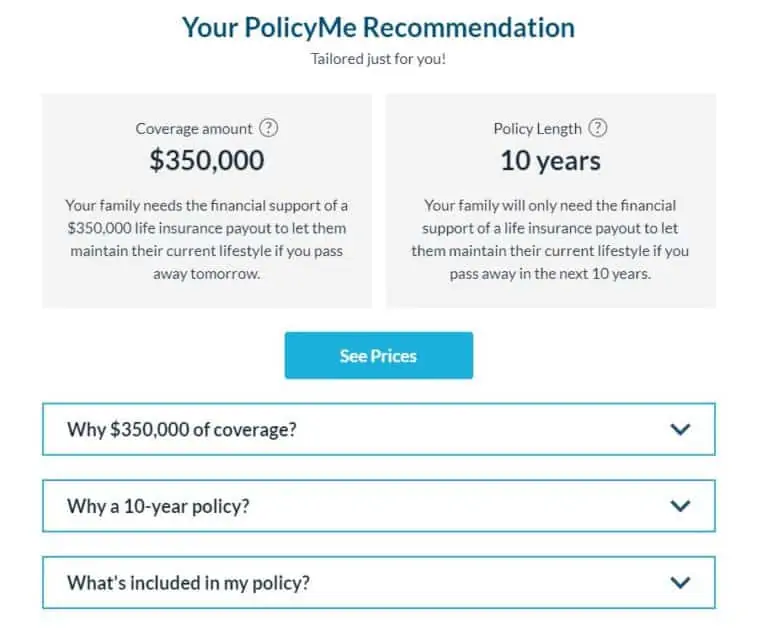

Visiting PolicyMe’s website involves entering basic personal details, which are used by their algorithm to estimate monthly expenses, recommended coverage amount, term length, and the reasoning behind these suggestions. This initial quote is obtained without the need for broker consultations.

Upon reviewing the estimated price, coverage, and term lengths, applicants can proceed to a full application, taking around 15 minutes to complete online. Unlike industry-standard procedures, PolicyMe’s streamlined process eliminates the need for a subsequent lengthy medical interview.

The information provided is promptly reviewed, offering instant approvals in most cases. This expedites the process, avoiding the typical 2-3 week waiting period for approvals with other insurers.

PolicyMe is a legitimate company operational since 2018. Initially functioning as a broker, it subsequently partnered with Canadian Premier, a well-regarded company with an A (Excellent) rating from A.M. Best and a customer base of over 2 million.

More than 50,000 individuals have used PolicyMe, rating it at 4.9/5 on reviews.io.

Life insurance provides a payout following the insured individual’s death. It acts as a financial safety net for dependents, ensuring they receive a tax-free lump sum.

There are two primary types of life insurance: term and permanent.

Protects for a specific duration (e.g., 5, 10, 15, or 20 years) and is generally more commonly used than permanent life insurance.

Covers the individual for life and necessitates fixed, more expensive premiums paid until death.

To reduce life insurance costs:

By comparing rates across insurance companies, you can select a life insurance package that suits your needs and budget. Based on the information provided, you could potentially save 26% to 50% compared to the market average.

PolicyMe’s approach significantly reduces term life insurance premiums by optimizing the underwriting process, enabling affordable protection for Canadian families.