When it comes to finding the right life insurance policy in Canada, the process can often be daunting and time-consuming. However, PolicyAdvisor.com is changing the game by providing a user-friendly online platform that allows Canadians to compare the best life insurance quotes from top insurance companies in the country. In this PolicyAdvisor review, we’ll explore how this innovative platform can help you streamline your insurance search, save on your premiums, and provide valuable advice.

PolicyAdvisor is a progressive online life insurance brokerage operating in Canada. Their mission is to make it effortless for individuals to find the most competitive rates for various insurance products, including life insurance, critical illness insurance, disability coverage, and mortgage protection insurance. The platform grants access to 20 of Canada’s leading life insurance companies, supported by licensed insurance experts who offer free guidance to help you select the ideal coverage for your unique needs. Some of the prominent insurance providers they collaborate with include RBC Insurance, BMO Insurance, Equitable Life, Manulife, Canada Life, Canada Protection Plan, La Capitale, Assumption Life, and others. It’s important to note that PolicyAdvisor.com is regulated by the Financial Services Regulatory Authority of Ontario (FSRA), and they currently offer their services in Ontario, Alberta, and Manitoba, with plans for expansion in the near future.

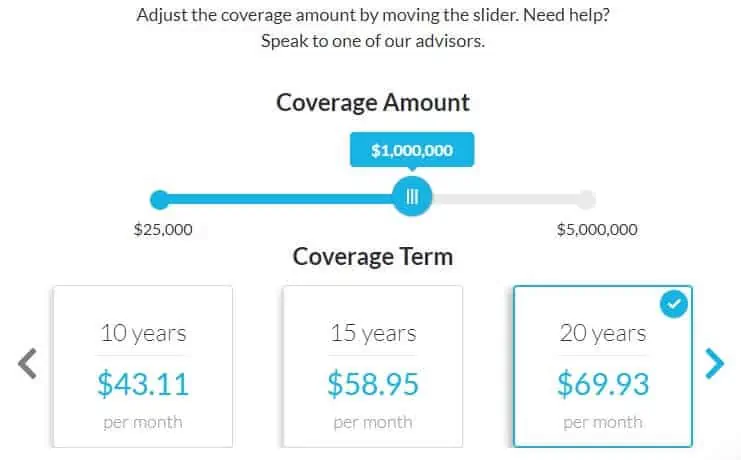

PolicyAdvisor simplifies the process of finding insurance coverage and competitive rates for a range of insurance products, all within a matter of minutes. By comparing rates online, you can potentially save up to 40% on your insurance premiums. Here’s how to get started:

As of now, PolicyAdvisor.com is only available to residents of Ontario, Manitoba, and Alberta. Additionally, the platform does not offer its own insurance products.

PolicyAdvisor does not charge customers any fees. Instead, they are compensated by insurance companies when customers purchase insurance products through their platform. This allows them to provide free access to research, articles, and insurance tools.

In conclusion, this PolicyAdvisor.com review highlights the platform’s ability to simplify the search for life insurance in Canada. If you are in the market for life insurance, PolicyAdvisor.com offers an efficient and convenient way to find the best rates while also providing valuable guidance. For more options on saving on life insurance policies, you can also explore our PolicyMe review.