Starting a business in British Columbia, Canada, is an exciting venture, but it does come with the responsibility of choosing the right business structure and registering it properly. You have several options to choose from, including sole proprietorship, partnership, and corporation. In this guide, we’ll walk you through the process of registering a sole proprietorship, partnership, or corporation in British Columbia, discussing the associated costs and offering a convenient solution using Ownr.

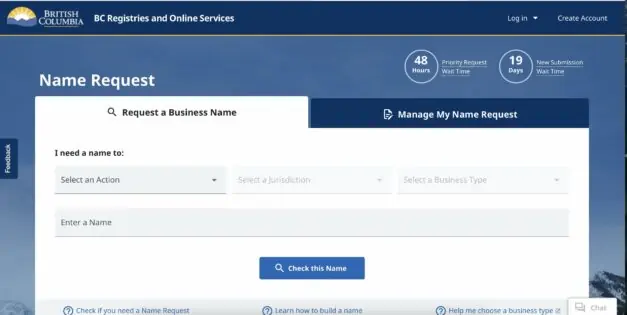

A sole proprietorship is a business with a single owner, while a partnership involves at least two individuals in a business venture. To get started, you must first select and reserve a business name. If you plan to operate a sole proprietorship under your own name, you can skip this step. For all other cases, you need to request a business name reservation at a cost of $30. This process ensures your chosen name doesn’t conflict with existing ones. You will receive a name request number, valid for 56 days.

Once you’ve secured your business name, you can proceed to register your business using BC’s registry services. Registration costs vary:

Upon successful registration, you will receive a business number and a Statement of Registration.

To complete the registration process, you must register with local, provincial, and federal government partners. Detailed information on this step can be found in the Small Business Resource Handout.

Ownr is a user-friendly service that simplifies the process of registering a business in British Columbia and several other Canadian provinces. It offers convenience and cost savings compared to hiring a lawyer.

Incorporating a business in British Columbia involves establishing a separate legal entity. This offers distinct advantages, including liability protection and potential tax benefits. Here are the steps to incorporate your business:

Incorporating a business in British Columbia involves establishing a separate legal entity. This offers distinct advantages, including liability protection and potential tax benefits. Here are the steps to incorporate your business:

First, determine the most suitable business structure for your needs. You can compare different structures and consider your specific goals. It’s advisable to consult with an accountant for guidance.

Select a business name that adheres to legal requirements, including a brand name, a descriptive element, and a legal ending such as Inc. or Ltd. Request and reserve the name online for a fee of $30. It must be approved to ensure it doesn’t conflict with existing names, and you’ll receive a name reservation number valid for 56 days.

The articles of incorporation serve as the rules for your company, outlining details about directors, officers, and shareholders. You may use a sample set or seek professional assistance. Different requirements apply to specific types of companies.

All incorporators who form the company must sign the incorporation agreement, which becomes part of the company’s records. Ensure it includes necessary information, such as each incorporator agreeing to take at least one share.

Submit your incorporation application online using Corporate Online, with a fee of $350 or $1,000 for a ULC. Benefit companies should apply using the BC Registry application online, also costing $350. Alternatively, complete a paper form and enlist a lawyer or registry agent to submit it. Once approved, you will receive several documents that should be maintained as part of the company records.

Ownr offers a simplified solution for incorporating your business in British Columbia. Follow these steps:

The cost for provincial incorporation in British Columbia using Ownr is $699, plus tax. By signing up through the provided link, you can enjoy a 15% discount. Furthermore, opening an RBC Business Bank Account within 60 days after incorporation may qualify you for up to $300 cashback. Additionally, Ownr provides access to perks like discounts on phone plans and office supplies.

Whether you’re establishing a sole proprietorship, partnership, or corporation, the outlined steps provide a clear roadmap to get your business registered in British Columbia. While the process may seem daunting for newcomers, Ownr offers a user-friendly, cost-effective solution to streamline

the registration process and avoid common pitfalls. Consider using this service to save time and ensure a smooth registration experience for your BC business.