Are you ready to turn your business idea into a reality? Whether you’re planning to operate as a corporation or a sole proprietorship in Alberta, it’s essential to know the steps for business registration. Not only does this formalize your business operations, but it’s also a legal requirement in the province.

In this guide, we’ll walk you through the process of registering your business name, establishing a sole proprietorship, and setting up a corporation in Alberta. We’ll also address some common questions you might have during this exciting journey of starting your business.

Choosing the right business name is a critical step in building your brand. Here’s how you can register your business name in Alberta:

Your business name should be unique enough to make your brand stand out. While identical business names can exist, be cautious if your chosen name closely resembles an existing business, corporation name, or trademark, as it may lead to legal challenges. Also, be aware that certain terms like “limited,” “incorporated,” or “corporation” (or their French or abbreviated forms) cannot be used in a business name if you are not registering a corporation.

For Limited Liability Partnerships (LLPs), you must include “limited liability partnership” or the abbreviation “LLP” at the end of the name. The same applies to French terms.

Consider obtaining a business name report from authorized NUANS members. This report contains registered business, corporation, and trademark names similar to the one you’ve proposed. While not obligatory for sole proprietorships, a business name report can provide insight into the uniqueness of your chosen name.

Depending on your business type, you’ll need to complete specific forms to register your business. For a sole proprietorship, fill out the “Declaration of Trade Name” form. For partnerships, use the “Declaration of Partnership” form. Limited partnerships require the “Application for Alberta/Extra-Provincial Limited Partnership” and “Special Authority to Execute a Registration.” LLPs need the “Application for Alberta/Extra-Provincial Limited Liability Partnership” and other related documentation.

After filling out the appropriate forms, fax or email them to the Alberta Corporate Registry at corp.reg@gov.ab.ca or fax number 780-422-1091.

once you’ve submitted the necessary forms, visit an authorized Corporate Registry service provider with your business name, business name report (if obtained), valid identification, and the $60 registration fee. If your information is accepted, it will be entered into the Corporate Registry, and you’ll receive proof of filing, along with your federal business number

If you are conducting business under a name other than your own and are not in partnership with anyone else, you must register your business as a sole proprietorship. Follow the steps outlined for registering a business name, and ensure you file the “Declaration of Trade Name” form within six months of commencing business operations with a name other than your personal name.

Even if you add “and company” or similar phrases to your name, you must still register your business.

For a more streamlined registration process, consider using services like Ownr:

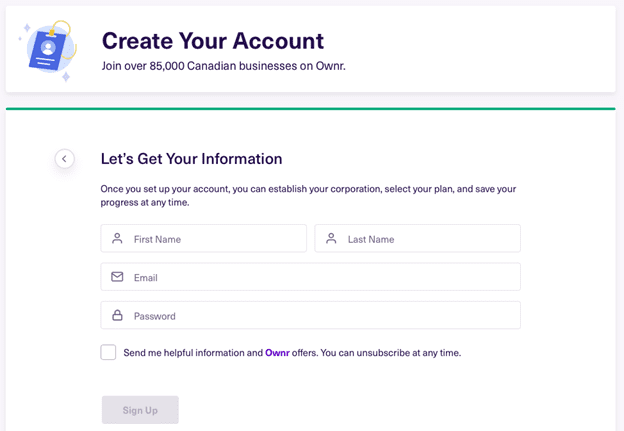

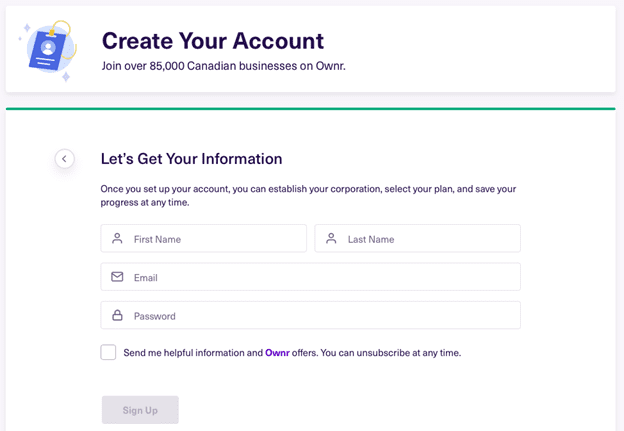

Visit Ownr’s website and select your province. Search for a suitable name for your business, and create an account. In Alberta, your company name should have a distinctive element (your brand name) and a descriptive element (describing your goods or services).

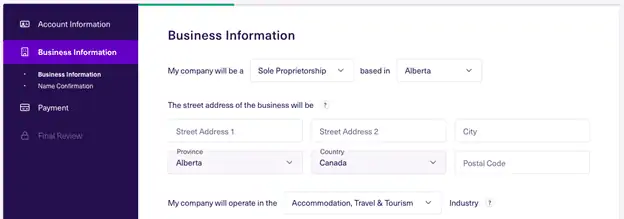

Once your account is set up, input your business details, including the type of business, location, industry, and your company name. Ownr’s user-friendly interface simplifies this process.

Pay the registration fee of $49 for a sole proprietorship in Alberta. After submitting, Ownr will send you all necessary information via email, including your business registration number and documents.

You can also receive a 15% discount when you sign up through Ownr’s exclusive link. If you open an eligible RBC business bank account, you may qualify for up to $100 cashback.

Registering a corporation in Alberta provides legal protection and benefits, no matter the size of your business. Follow these steps to incorporate:

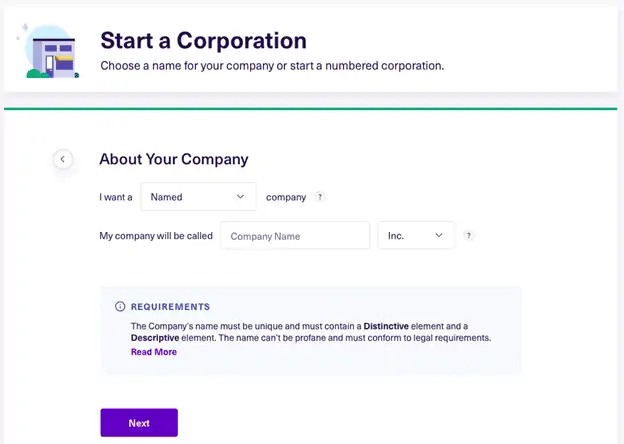

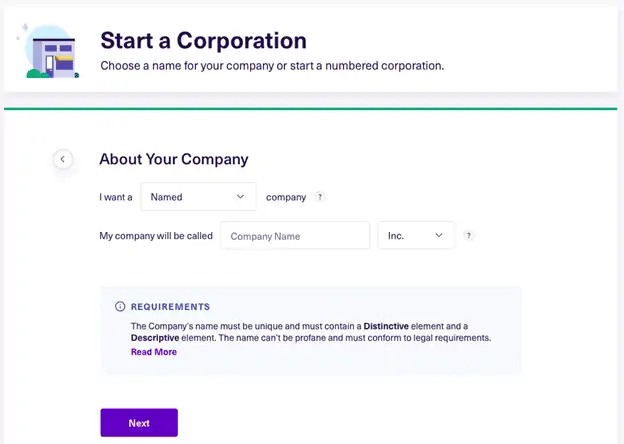

Select a corporation name that includes a distinctive, descriptive, and legal element. The legal element in Alberta should be “Limited,” “Corp.,” or “Ltd.” You can also have a numbered corporation, where the name includes “Alberta” and a legal element at the end.

Order an Alberta NUANS report to ensure that your chosen corporation name is unique and not similar to existing names. This report reserves your name for 90 days. The NUANS report costs $50.

Complete the necessary forms for your corporation, including Articles of Incorporation, Notice of Address, Notice of Directors, and Notice of Agent for Service. Ensure all forms are filled out accurately.

Visit a registry agent or an authorized Alberta service provider, bringing all your completed forms, the NUANS report, valid identification, and the required fee. If your information meets the requirements, you’ll receive a certificate of incorporation, along with your federal business number.

For a simplified process, consider using Ownr for incorporating your business:

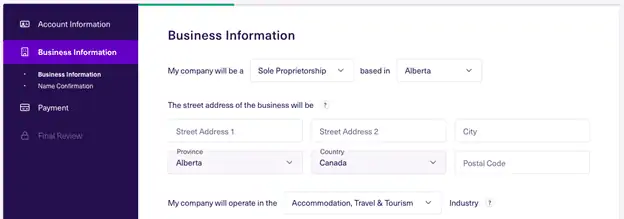

Select your province, confirm that you’re registering a corporation, and search for a unique name for your business.

Fill in your corporate information, ownership details, and shareholder information. Ownr’s user-friendly interface streamlines the process.

Pay the $599 fee to incorporate in Alberta through Ownr. You can also receive up to $300 cashback by opening an RBC Business Bank Account within 60 days of incorporating via Ownr.

Once you submit and pay, Ownr will provide you with all the necessary documents and information via email.