Bounc3 is on a mission to revolutionize the accessibility of insurance products for self-employed Canadians, including business owners, freelancers, and gig workers. In this review, we’ll explore how Bounc3 works and how it offers affordable insurance options in Canada.

Bounc3 is an innovative online insurance broker catering to residents of Ontario, British Columbia, and Alberta. The platform has established partnerships with several prominent insurance companies in Canada, simplifying the application process for various insurance products and offering competitive rates. Designed with small business owners and freelancers in mind, Bounc3 provides a user-friendly online application process and personalized insurance quotes. Dr. Olga Morawczynski, a licensed insurance broker in Ontario with a Ph.D. in digital finance, founded Bounc3.

ounc3 offers three key types of insurance coverage:

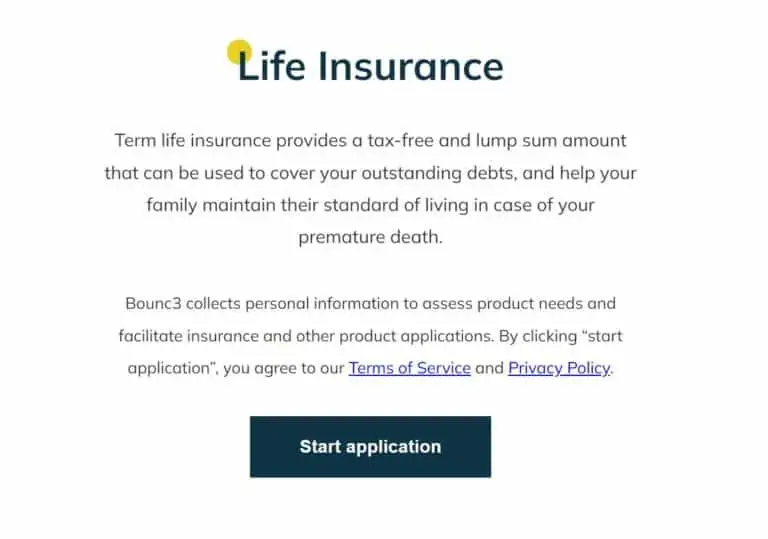

Life insurance is a contract between you and an insurance company, where they promise to pay a lump sum to your beneficiaries upon your death. In return for this death benefit, you pay regular premiums. Two primary types of life insurance policies are available: term life insurance and permanent life insurance. Life insurance serves as a financial safety net for your family, helping them manage expenses, pay off debts, or fund important goals like education.

Term life insurance, in particular, offers cost-effective premiums and flexible coverage durations, such as 10, 20, or 30 years, with the option to convert to permanent life insurance later.

Critical illness insurance provides a lump sum cash benefit if you’re diagnosed with a severe medical condition, such as cancer or a stroke. The funds can be used for any purpose and are tax-free. For self-employed individuals, this coverage can be a financial lifeline during illness, helping cover expenses not included in provincial or private health plans.

Disability insurance is designed to offer tax-free monthly payments to replace a portion of your regular income if you become ill or injured and are unable to work. It’s especially important for those who lack coverage through their employment. Disability insurance can be divided into two main categories: short-term and long-term disability insurance. It covers a wide range of illnesses and injuries and can even provide support for retraining and returning to work.

If you operate a corporation or are a sole proprietor with at least one employee, you may qualify for a Health Spending Account (HSA). HSAs can be used to provide benefits to employees and cover medical expenses not reimbursed through existing healthcare plans, whether private or provincial.

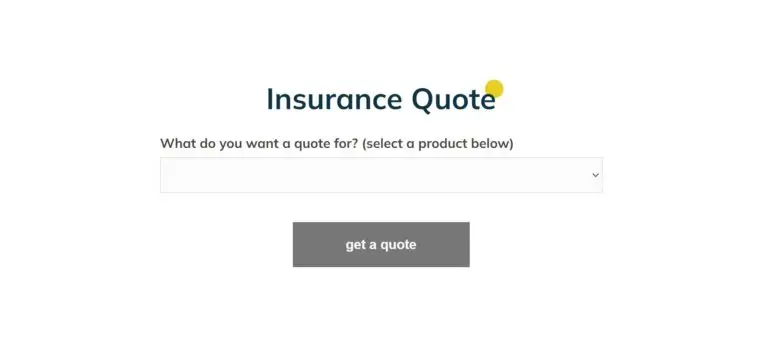

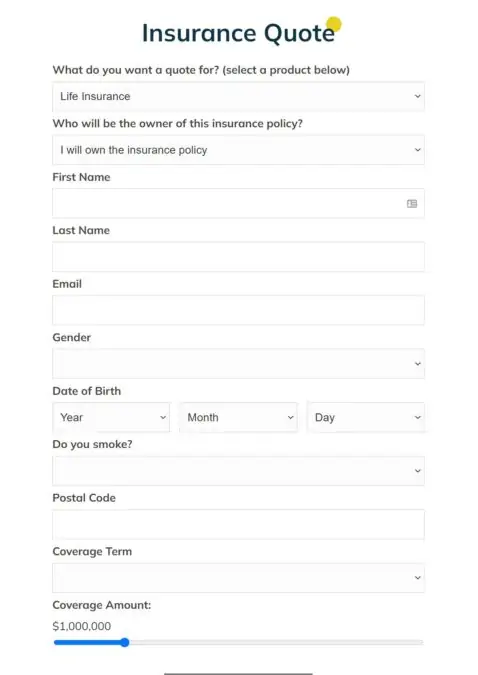

Applying for insurance with Bounc3 is a straightforward process:

Visit the Bounc3 website and begin your online application by selecting the type of insurance you’re interested in.

Complete your personal details, including coverage term and amount. This step takes only 1-2 minutes, and you’ll receive preliminary quotes instantly.

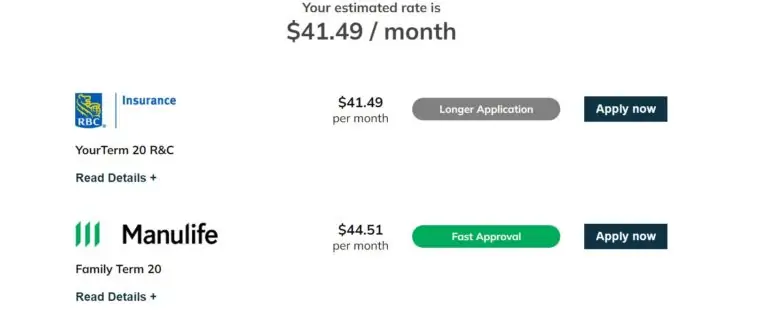

For example, for a 20-year coverage term and a $1 million coverage amount for a 30-year-old non-smoking female, you could expect estimated quotes as follows:

After obtaining your initial quotes, you can proceed to complete the rest of your application online.

Bounc3 offers numerous advantages:

However, it’s important to note that Bounc3’s services are currently limited to residents of Ontario, Alberta, and British Columbia. They have plans to expand to other provinces in 2022.

If you’re a small business owner, freelancer, or gig worker without insurance coverage, Bounc3 provides a convenient solution to explore your options. The application process is quick and straightforward, and you can receive free guidance from licensed advisors to make informed decisions about your insurance needs. Take a few minutes to explore what Bounc3 can offer and secure your financial future today.