Travel insurance is an important consideration for travelers, as it can provide financial protection and peace of mind in case of unexpected events. In this article, we will explore travel insurance in Canada in 2023, including what it covers, how it works, its cost, and the top 8 travel insurance providers in the country.

Travel insurance is designed to cover unforeseen losses or damages that may occur while traveling, whether domestically or internationally. It typically includes various forms of coverage, such as:

Coverage for unexpected medical expenses incurred during your trip.

Protection in case you become injured or ill while traveling.

Compensation in the event of a flight accident.

Coverage for lost, damaged, or stolen baggage and personal items.

Reimbursement for non-refundable travel expenses if your trip is canceled or interrupted.

A lump sum payment to beneficiaries in case of accidental death during your trip.

In addition to these coverages, travel insurance often provides access to various assistance services, such as medical treatment coordination, emergency assistance, interpretation services, and more.

Travel insurance can be divided into two main categories of coverage:

This includes short-term and major medical coverage. Short-term policies cover trips ranging from a few days to a year, while major medical coverage can extend to six months or longer. These policies can help cover unexpected medical expenses, facilitate access to healthcare services, and provide services like medical evaluations, emergency airlift, and extended hospital stays if needed.

This coverage safeguards against the loss, damage, or theft of your baggage and personal items, up to a specified limit, especially when airlines or carriers might not fully compensate you.

If your trip is canceled or interrupted due to unforeseen events covered in your policy, this insurance reimburses you for non-refundable travel expenses.

In the unfortunate event of a flight accident or common carrier incident, this coverage provides a lump sum payment to beneficiaries. It is important to note that this coverage may not apply if you have pre-existing health conditions or if your life insurance policy already covers such situations.

The cost of travel insurance can vary depending on several factors, including the provider, the specific coverage package, your age, trip duration, smoker status, pre-existing conditions, policy type, and deductible amount. On average, travel insurance costs approximately $248 per trip, which represents about 4% to 8% of the total cost of your trip.

Here are eight reputable travel insurance providers in Canada, each offering different plans and benefits. It’s essential to review their offerings and choose the one that best suits your needs:

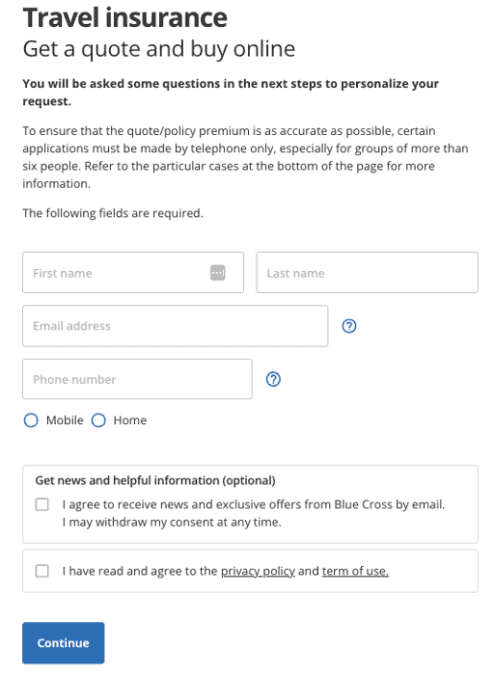

Blue Cross offers various plans with comprehensive coverage, including Emergency Medical Care, 24/7 travel assistance, and free coverage for children. Their plans can be tailored to your specific needs, covering emergency medical care, baggage, accidental death or dismemberment, and trip cancellation or interruption.

Allianz offers a range of plans, including OneTrip and AllTrips categories. These plans cover aspects like trip cancellation, emergency medical care, baggage loss, and more. They have options for single and multi-trip coverage.

The Canadian Automobile Association (CAA) offers different travel insurance plans for various needs, including Emergency Medical, Trip Cancellation and Interruption, Vacation Package, and a Visitors to Canada Plan. CAA members can enjoy a 10% discount on travel insurance plans.

World Nomads is known for its flexible trip insurance, ideal for independent travelers and adventurers. They cover over 250 outdoor activities and offer coverage for trip cancellation, emergency medical insurance, gear protection, and more.

Co-operators’ travel insurance caters to both Canadian residents and visitors to Canada, providing coverage for trip cancellation, emergency medical care, and hospital bills.

Desjardins offers travel insurance for various types of travelers, with options for short trips, extended stays, and frequent travel. Their plans include coverage for emergency health care, emergency return trips, accidents, baggage, and trip interruption or cancellations.

Costco members can access Manulife travel insurance at discounted rates. Manulife offers three plans for Canadians: Travelling Canadians, Students, and Visitors to Canada. These plans include an emergency medical concierge service called StandByMD.

Endorsed by the Royal Canadian Legion and the Canadian Snowbird Association, Medipac provides comprehensive travel insurance coverage for up to $5 million USD. They claim to offer competitive rates, saving clients approximately 28% annually.

Getting a travel insurance quote is a straightforward process that typically involves the following steps:

Start by selecting a reputable travel insurance provider that offers coverage suitable for your travel needs. You can do this by visiting their official website or contacting them directly.

Access the official website of the chosen travel insurance provider.

Look for options like “Get a Quote,” “Get a Quote Now,” or “Get Started Now” on the provider’s website. This option is typically prominently displayed on the homepage.

Indicate whether you are a Canadian resident or a visitor to Canada. This step ensures that you receive the appropriate coverage based on your status.

Specify whether you are covered by the public healthcare plan in your province. This information helps determine the extent of medical coverage you may need.

Select the age range that corresponds to your age. Different age groups may have varying insurance requirements and premium rates.

If you are traveling with others, enter the details of all individuals who need coverage under the policy. This typically includes their names and ages.

Review and select any optional coverage options that are offered by the provider. These options may include extended medical care, trip interruption or cancellation, and more.

The provider may allow you to customize your coverage further, such as choosing a deductible amount and adjusting the cost per traveler based on your specific needs.

Double-check all the information you have provided to ensure accuracy. Ensure that you have selected the desired coverage options.

After confirming your choices, the system will generate a personalized quote for your travel insurance. This quote will include details about the coverage and the associated costs.

If you are satisfied with the quote and ready to proceed, you will be guided through the payment process. You may need to provide payment details, such as credit card information, to purchase the insurance.

Once the payment is processed, the provider will typically send you policy documents and confirmation via email. It’s essential to review these documents carefully and save them for reference during your trip.

You can save on travel insurance by considering the following tips:

If you travel frequently, opt for multi-trip or annual coverage, which can be more cost-effective than buying insurance for each trip individually.

If you’re traveling with family or a group, explore group discounts and benefits for dependent children, which may be included in some policies.

Premiums often increase with age milestones (e.g., 55, 60, 65). Purchase insurance before your next birthday to secure a lower rate.

Travel insurance typically does not cover non-emergency care, routine check-ups, cosmetic surgery, or pre-existing conditions. It may also exclude extreme sports and mental health disorders. It’s essential to review the specific policy exclusions of your chosen provider.

For instance, high-risk pregnancy, routine natal care, and activities like rock climbing may not be covered by some travel insurance policies.

The necessity of travel insurance depends on your circumstances and preferences. It is worth considering if you are concerned about protecting your valuables, dealing with delayed or canceled flights, and managing emergency medical expenses.

Canadian health insurance is generally not valid outside the country, so having travel insurance can be a financial safety net. Moreover, travel insurance can provide coverage for baggage and offer protection against unforeseen trip disruptions.

If you travel frequently or have concerns about potential risks, travel insurance may be a valuable investment. However, it’s essential to weigh the advantages and disadvantages and compare multiple providers before making a decision.