600 Credit Score: What Are Your Credit Card And Loan Options

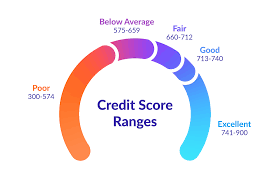

A credit score of 600 is considered a “fair” credit score in Canada. While it may not be classified as excellent or even good, it’s not necessarily bad either. This score places you in a gray area where you may qualify for some credit cards and loans, but traditional banks may still view you as […]