In Canada, routing numbers play a vital role in directing financial transactions within banks. They consist of a combination of a transit number and a financial institution number, allowing for the identification of specific bank branches, and are utilized for both cheque and electronic transaction processing.

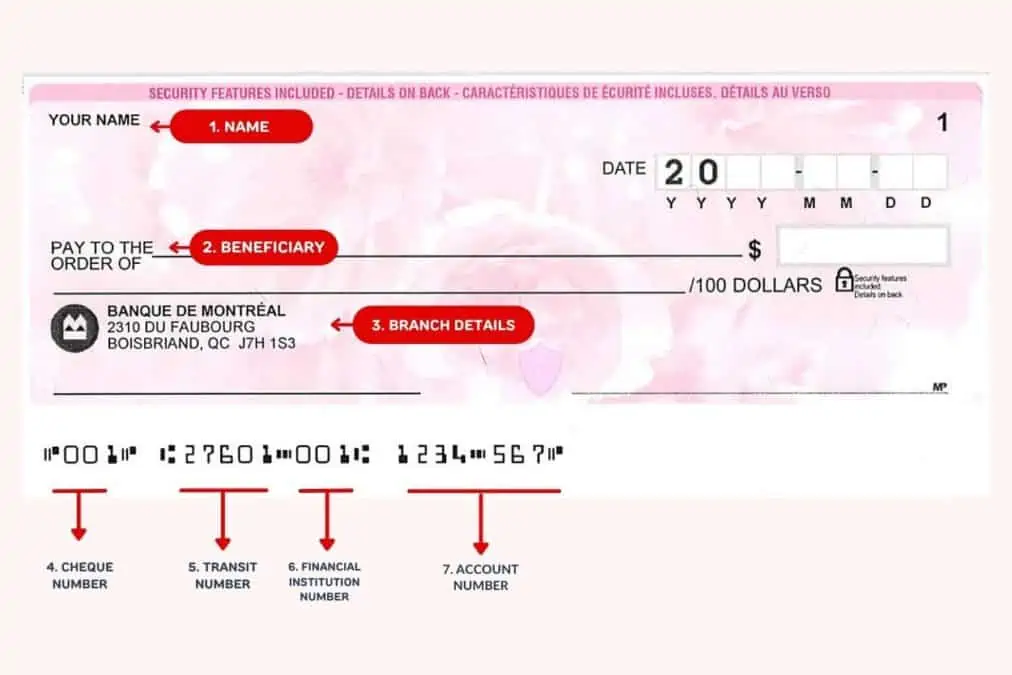

A routing number comprises a five-digit transit number specific to the branch where the bank account was opened, and a three-digit institution number identifying the bank itself. These numbers are presented in two formats, distinguishing between electronic and paper transactions.

Routing numbers ensure accurate routing of funds in electronic transfers to the correct account and expedite verification and transaction fulfillment in paper-based transactions, such as cheque processing.

Although BMO routing numbers aren’t explicitly stated on a cheque, they can be derived from the numbers present. Remember, the BMO institution number is 001. Locate the five-digit transit number, positioned to the left of the institution number at the bottom left of the cheque. Utilize the provided formats to structure your routing number.

By understanding how routing numbers function and employing the available methods online or through cheques, locating your BMO routing number is straightforward for executing various financial transactions accurately within Canada.