Emma is an online platform that offers a convenient way to purchase life insurance policies in just a few minutes. This review will explore how Emma works, the cost of life insurance through their platform, and its legitimacy.

Emma is a fintech company specializing in insurtech, founded in 2017. Their online platform allows you to compare life insurance quotes from the comfort of your home. Emma has established partnerships with some of the top life insurance companies in Canada, including:

These partnerships enable you to access the best rates available without the need to apply to each company individually.

Emma’s platform is designed to make life insurance more accessible and affordable, particularly for young families.

There are two primary types of life insurance: term life insurance and permanent life insurance, both of which Emma offers:

This type provides coverage for a specified period (e.g., 10-20 years) and pays a tax-free benefit to your beneficiaries if you pass away during this time.

This type offers lifelong coverage and pays a death benefit to your beneficiaries as long as the contract is in force at the time of your death. Permanent life insurance is also known as whole life insurance and comes in different variations.

Term life insurance is generally more affordable and popular than permanent life insurance.

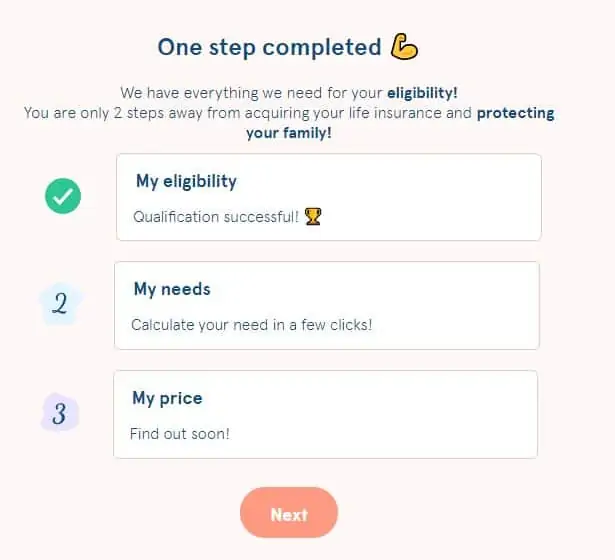

Buying life insurance through Emma is a straightforward process:

Visit Emma’s website to check your eligibility.

Complete an online health survey, which takes just a few minutes.

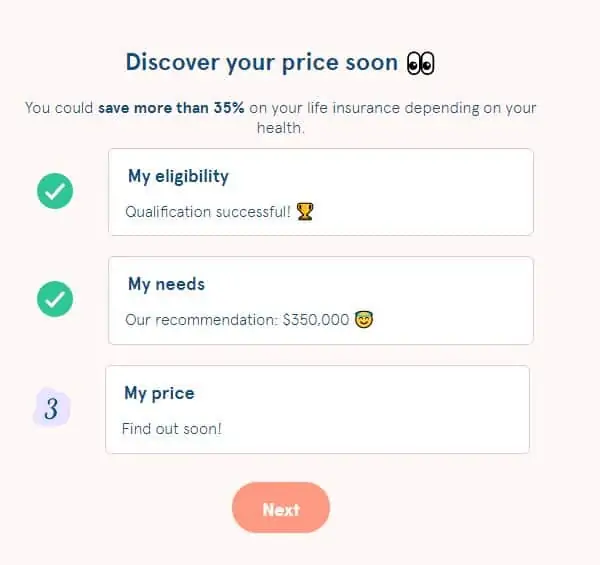

Provide details about your insurance needs, allowing Emma’s proprietary algorithm to calculate your ideal coverage.

Once this is done, you’ll receive a quote for your monthly premiums. You can adjust your coverage to see how it affects your premium.

If needed, you can chat with an Emma expert to finalize your application. You have up to 15 days to request a refund if you change your mind.

The cost of life insurance is influenced by various factors, including:

Generally, the older you are or if you smoke or have chronic medical conditions, your life insurance costs will be higher.

The Emma life insurance platform offers several advantages, including:

If you have a complex medical history, an online life insurance application may not be suitable for your needs. Additionally, Emma’s life insurance offerings are somewhat limited.

Emma is a reputable company with positive reviews from real users on Trustpilot and Facebook, both of which have given it a rare 5/5 rating. Emma also offers life insurance products from major insurance companies in Canada.

Life insurance is a crucial part of financial planning, and Emma aims to simplify the process for young, busy parents who want to protect their loved ones. If you’ve been hesitant to apply for life insurance due to cost or hassle, Emma provides a user-friendly solution. You can also compare rates using other platforms like PolicyMe to find the best life insurance options in Canada.