For Canadian homeowners, the idea of securing their mortgage through life insurance is a significant decision. Mortgage life insurance, specifically designed to cover outstanding mortgage debt in the event of the policyholder’s death, offers some essential benefits but also comes with certain considerations.

Mortgage life insurance in Canada provides protection for your family in case of an unexpected demise, ensuring that the remaining mortgage balance doesn’t become a burden. It differs from mortgage default insurance, which safeguards the lender in case of default, by primarily focusing on the beneficiaries, typically the family of the insured.

Not to be confused with mortgage disability insurance that offers coverage if the insured faces illness or disability affecting their ability to pay the mortgage, mortgage life insurance provides a sense of security, especially for first-time home buyers with substantial mortgage commitments.

It’s essential to note that while mortgage life insurance is not mandatory when taking out a mortgage, many Canadians opt for it to mitigate financial risks associated with the remaining mortgage.

Differentiating mortgage life insurance from regular life insurance is crucial. With life insurance, the beneficiary receives a lump sum payout, offering flexibility in its utilization. This could include paying off the mortgage or addressing other financial needs.

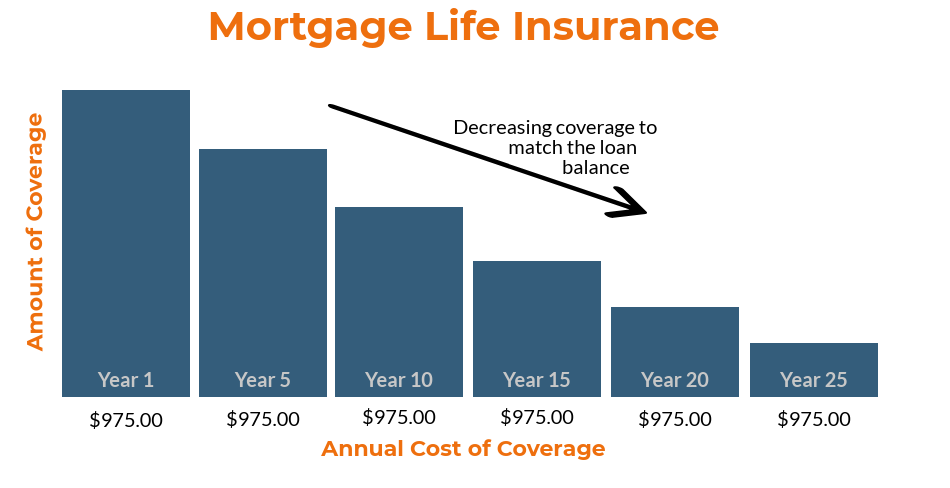

Contrarily, mortgage life insurance is specifically tailored to cover the outstanding mortgage amount and provides a payout directly to the lender. Moreover, as the mortgage gets paid down, the coverage amount decreases over time.

Typically offered through mortgage lenders or separate life insurance companies at the initiation of a mortgage, mortgage life insurance’s premiums vary based on factors like the mortgage size, age of the insured, and the insurance provider. Payments are commonly made along with the monthly mortgage installment, simplifying the process for policyholders.

However, it’s important to note that coverage diminishes as the mortgage is paid off, while the premiums usually remain fixed. Age limits often exist for obtaining this insurance, with rates potentially higher for older applicants.

The necessity for both types of insurance depends on individual circumstances. If an existing life insurance policy adequately covers the mortgage and offers flexibility in using the payout, additional mortgage life insurance might not be imperative.

However, for those without either insurance, it’s essential to weigh the costs and benefits of both and consider personal and financial circumstances before making a decision.

The worth of mortgage life insurance in Canada is subjective and depends on individual preferences and needs. For individuals without life insurance coverage, mortgage life insurance can provide peace of mind, ensuring that loved ones won’t face mortgage-related financial strains.

However, it’s crucial to explore options thoroughly. Individual life insurance might offer more flexibility and affordability. Careful consideration of the pros and cons will help in deciding which insurance aligns better with the needs of the insured and their family.

In conclusion, the decision to opt for mortgage life insurance in Canada involves careful evaluation of personal circumstances, needs, and the advantages and limitations of the available insurance options. Making an informed decision can ensure adequate financial protection for the insured and their family.