Royal Bank of Canada (RBC) is one of several banks that provide their customers with access to complimentary credit score checks. You can easily access your free RBC credit score online through your account using the “Credit View Dashboard.” It’s important to note that this credit score check is considered a “soft inquiry,” meaning it won’t have a negative impact on your credit rating. Additionally, Canadians have other options for obtaining their updated credit scores and reports, such as platforms like Borro-well.

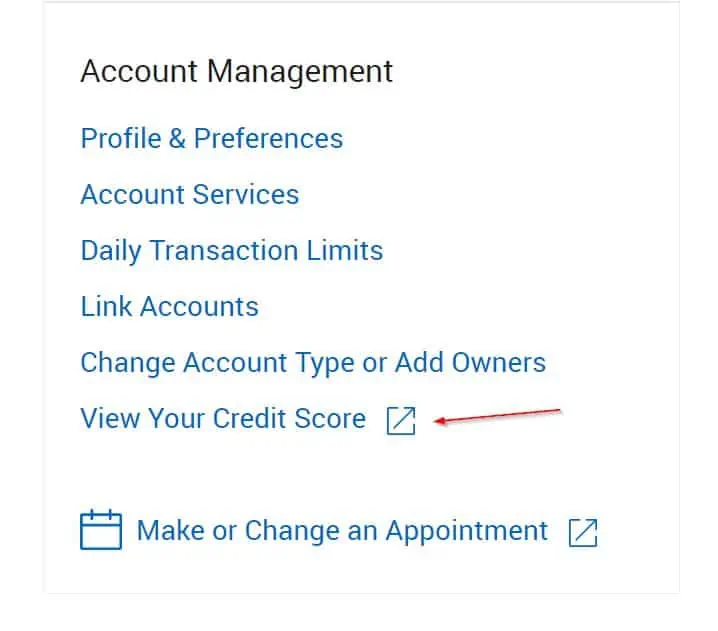

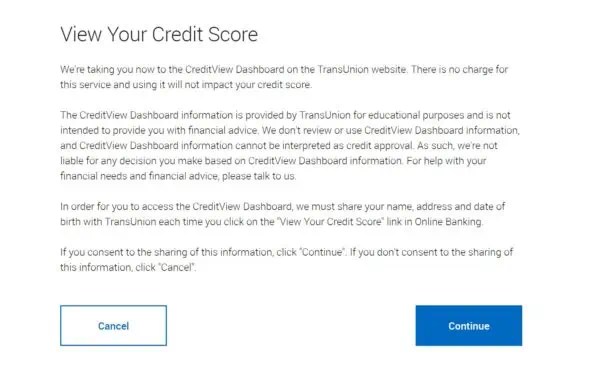

Follow these simple steps to check your credit score on RBC:

1. Sign in to RBC Online Banking.

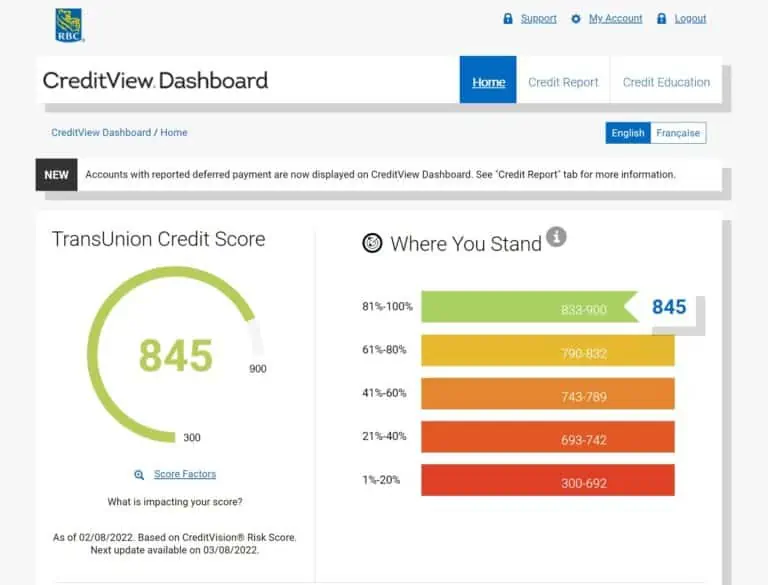

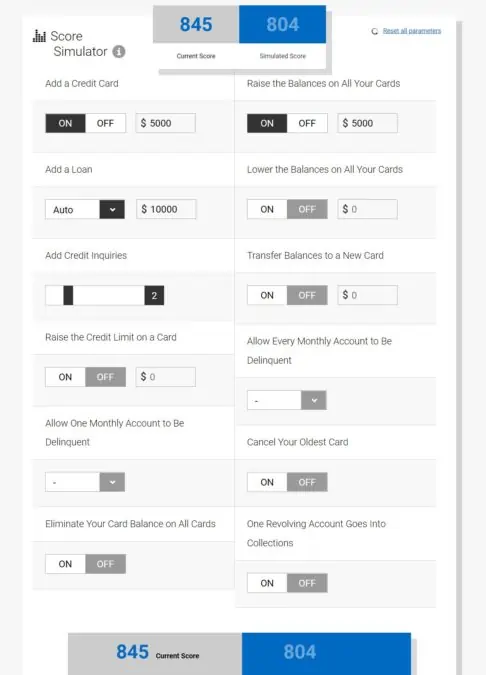

Similar to other credit scores in Canada, RBC’s credit score range is from 300 to 900. The dashboard also provides valuable information about your credit score history, comparisons with the general population, and access to your TransUnion credit report. Moreover, there’s a credit score simulator that estimates how your credit score may change based on specific actions, such as adding a credit card or loan, reducing card balances, increasing your credit limit, canceling your oldest card, or missing a monthly payment.

Now that you’ve seen your credit score, let’s decipher what it means. A good RBC credit score typically falls between 743 and 789, while a score ranging from 790 to 900 is considered excellent. Lenders use your credit score to assess your creditworthiness. The higher your credit score, the better your chances of qualifying for various types of credit, such as personal loans, car loans, mortgages, and credit cards.

If your credit score is below 660, it’s categorized as poor or bad credit, and you may encounter higher interest rates if your credit applications are approved.

Several factors are taken into account when calculating your credit score, including:

To increase your RBC credit score, consider these steps:

Apart from RBC, several financial technology companies offer free credit score checks online. Here are a few:

Borrowell has been providing free credit score checks since 2016. Over 2 million Canadians have already utilized the platform to access their free Equifax credit score and report. Borrowell updates your score weekly, making it convenient to monitor your credit.

Credit Karma, like RBC, provides clients with access to their TransUnion credit score. You can also view your report, which is updated monthly.

Loans Canada offers free access to your Equifax credit score and assists in comparing loans from various Canadian lenders.

Through the CreditView Dashboard via RBC, you can access your TransUnion credit report. Alternatively, you can contact TransUnion directly at 1-855-889-4293 to request a copy of your Consumer Disclosure (i.e., credit report). For Equifax Canada credit reports, you can view weekly updates using Borrowell or reach out to Equifax directly at 1-800-465-7166.

No, you cannot view your credit score using the RBC mobile app. You need to sign in to Online Banking through the RBC website.

Yes, your RBC credit score is accurate and is based on TransUnion’s CreditVision Risk Score. However, it may differ from your TransUnion score or the report that lenders use when you apply for credit.

RBC retrieves your TransUnion credit score report when you apply for a credit card or loan.

Yes, a credit score of 800 is considered good, and you could qualify for credit at competitive rates.

We have outlined various strategies to improve your credit score quickly in this guide.

The content provided on Myfinancesguru.com is information to help users become financially literate. It is neither tax nor legal advice, is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional. We make no representation or warranty of any kind, either express or implied, with respect to the data provided, the timeliness thereof, the results to be obtained by the use thereof or any other matter.