Clear Score is a service that provides free access to your credit score in several countries, including Canada. It’s designed to help individuals monitor their credit health and make informed financial decisions. In this detailed Clear Score Canada review, we’ll explore how it works, its safety, legitimacy, accuracy, and more.

Clear Score expanded its services to Canada in 2022 and has already gained over 90,000 users in the country. It offers access to your TransUnion credit score and credit report, updated weekly, making it easy to track your credit profile over time.

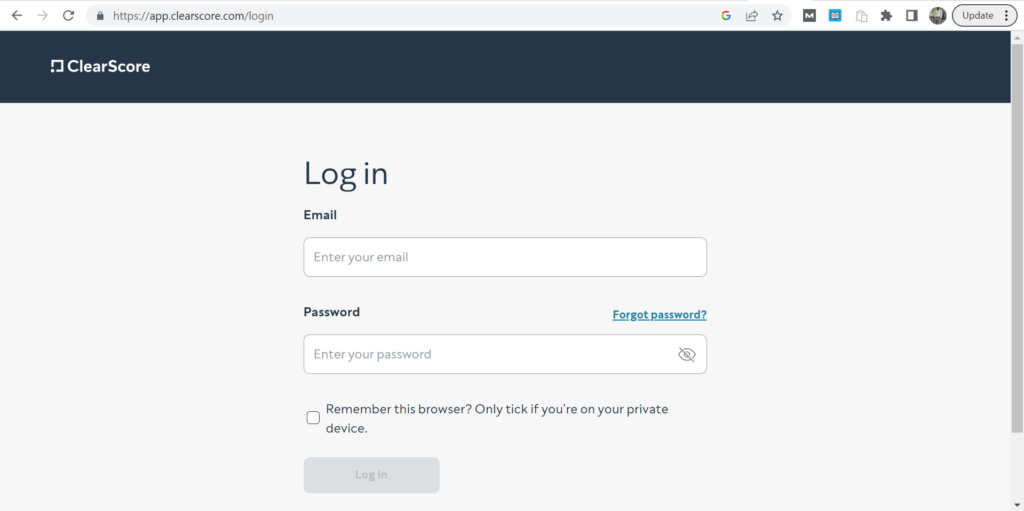

To use Clear Score for checking your credit score, follow these simple steps:

1. Sign Up: Provide your email address on Clear Score’s website.

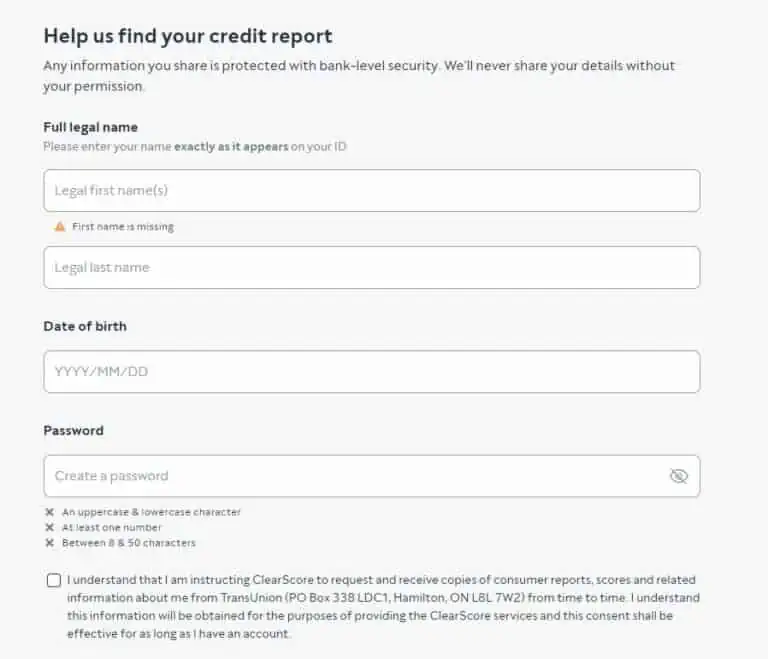

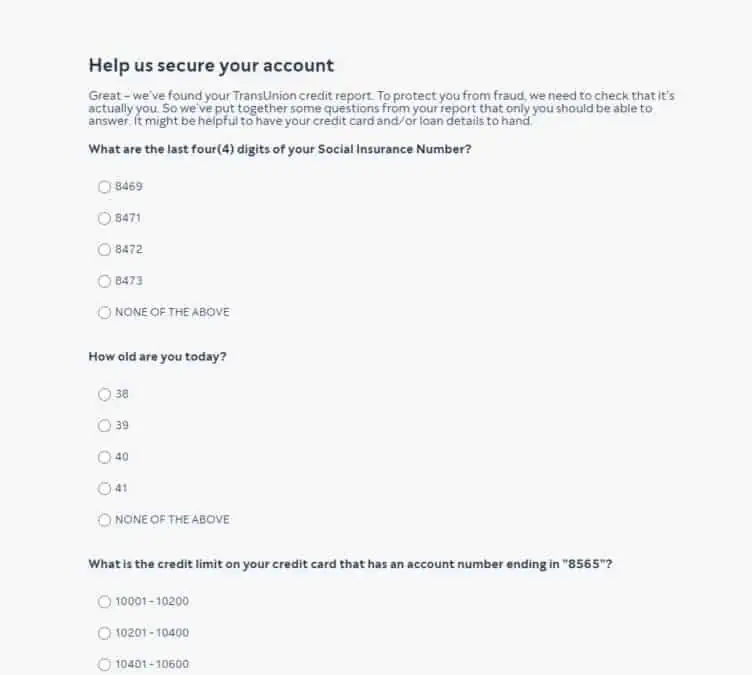

2. Complete Your Profile: Fill out your name, date of birth, and create a password. You’ll also need to provide your home address.

Once you’ve completed these steps, you can view your TransUnion credit score, typically ranging from 300 to 900. Additionally, Clear Score provides a detailed credit report, including information on credit inquiries, open credit accounts, credit utilization, payment history, and more.

Clear Score also offers identity protection monitoring. You can access a security score that provides details about exposed passwords in data breaches, security tips, and more.

In the ClearScore marketplace, you can explore offers from various lenders, including credit cards, loans, and mortgages. The platform uses your credit profile to suggest financial products that align with your creditworthiness.

Offers are ranked based on your likelihood of approval and the value they offer. You can also quickly determine the potential rewards from credit card offers

Clear Score’s credit scores are directly sourced from TransUnion, one of the major credit bureaus in Canada. Therefore, the credit score you receive from Clear Score is accurate. However, keep in mind that credit scores may differ slightly between bureaus due to variations in scoring algorithms.

Clear Score is a legitimate company with over 19 million users globally. It operates in multiple countries and has a registered office in Canada. The company claims to use robust security measures, including 256-bit encryption and bank-level security, to protect user accounts. It also has partnerships with reputable financial institutions in Canada.

Clear Score’s credit scores in Canada typically range from 300 to 900. Here’s a general breakdown of score categories:

Clear Score generally receives positive reviews from users. On Trust pilot, it has a rating of 4.4/5 from over 10,500 reviews. On the App Store, it scores 4.7/5, and on the Google Play Store, it has a rating of 3.7/5.

Several alternatives to Clear Score are available in Canada for accessing your credit score for free. Some notable ones include:

1. Borro-well: Borro-well provides access to your Equifax credit score and offers a credit builder program.

2.KOHO Credit Builder: KOHO is a prepaid card that offers up to 5% cashback on purchases and includes a credit builder product to help improve your credit history.

3. Loans Canada: Loans Canada provides free access to your Equifax credit score and allows you to compare loan rates from various lenders.

ClearScore is a reputable platform that offers free access to your TransUnion credit score and credit report in Canada. It provides users with valuable tools to monitor their credit health, identity protection features, and personalized financial product offers. While it may send credit card offers via email and is not available in Quebec, ClearScore generally provides a user-friendly experience for Canadians seeking to track their credit profiles.

The content provided on Myfinancesguru.com is information to help users become financially literate. It is neither tax nor legal advice, is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. Tax, investment and all other decisions should be made, as appropriate, only with guidance from a qualified professional. We make no representation or warranty of any kind, either express or implied, with respect to the data provided, the timeliness thereof, the results to be obtained by the use thereof or any other matter.